5 Irreversible Retirement Mistakes

We all make mistakes. Sometimes mistakes can create an opportunity to learn. At other times, we can “fix” the mistake and move forward. However, there are occasions when mistakes are irreversible and can have a lasting impact on your life.

When it comes to retirement, irreversible mistakes can impact your financial stability when work life ends. The following are the top five irreversible retirement mistakes.

-

Planning to Work Forever

Today you have good health, you love your job, and cannot imagine ever “retiring.” The lure to remain in the workforce can lull you into complacency regarding your retirement investments. After all, if you never stop working, you won’t need a large stockpile of cash to cover your financial needs.

However, this plan can backfire.

Fifty-three percent of workers plan to continue working past the age of 65. Yet, only 20% of Americans over the age of 65 remain employed. Meaning 1/3 of those who planned to continue working are unable to work as planned.

You might be forced to stop working for a number of reasons. The most common include personal health issues, the illness of a loved one, or a job loss. Another common issue is the failure to maintain and upgrade job skills. Once you take time off from work or leave a job, it can be very difficult to find a suitable replacement.

Only 28% of baby boomers surveyed have a backup plan for their retirement if they are unable to continue working.

-

Procrastinating

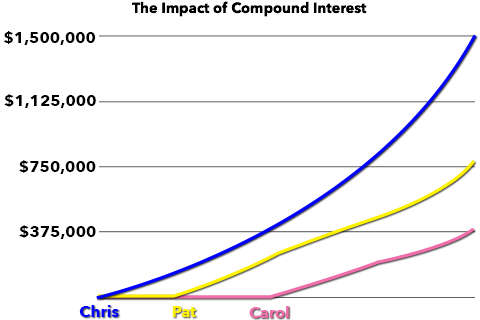

Time is one of the biggest elements of investment account growth. The longer you have before retirement, the less you must save to reach your goals. Any delay in saving money is time you cannot get back. The chart below is an example illustrating the power of compound interest:

In the example, each person contributes $1,000 per month for ten years and receives an average rate of return of 7%. Chris contributes from age 25 to 35. Pat contributes from 35 to 45, and Carol contributes from 45 to 55. At the age of 65, Chris has an account balance of $1,444,969, Pat's account grew to $734,549, and Carol's balance was only $373,407.

Time was the only difference.

Waiting to start a retirement plan is an irreversible mistake because you cannot get more time. This scenario is one of the biggest regrets for individuals who wait until their 40s or 50s to begin thinking about funding their retirement.

To build a $1 million investment nest egg by the age of 65, assuming an annual rate of return of seven percent, you must save $381 a month if you are 25, $820 a month at 35, $1,920 per month starting at 45, and $5,778 each month starting at the age of 55.

-

Claiming Social Security Too Soon

You can claim Social Security benefits as soon as 62. However, claiming at the earliest age will permanently reduce your monthly payout. Current retirees have a full retirement age between 66 and 67. For individuals born after 1959, the full retirement age is 67. Taking Social Security benefits before the full retirement age will cost you money each month, and a delay in claiming benefits will result in a larger monthly payout. A delay of three years, until you reach 70, will result in up to a 30% increase in every payment. There are no additional retirement credits after the age of 70.

If your full retirement age is 67 and you receive your Social Security benefits at 62, your monthly check is reduced by up to 25%, for the rest of your life.

Claiming methods may differ depending on your circumstances. Divorced spouses, widows, and couples can implement different strategies to maximize Social Security benefits.

-

The Needs of Your Children Come Ahead of Your Retirement Needs

Parenting children creates a strong pull to help them under any circumstance. However, helping adult children can have negative effects on your finances without realizing the long-term impact. Whether you choose to pay for private education, a wedding, or co-sign for a student loan, you could end up shouldering those costs well into retirement.

The debt incurred to help adult children can result in fewer dollars saved for retirement. You could end up with a financial shortfall at a time where it is difficult or impossible to bridge the gap. Instead of paying for the financial needs of adult children, teach them the financial skills needed to solve their own financial dilemmas.

For example, rather than taking out a loan to pay for your child’s college, teach them how to locate and apply for scholarships and grants.

You cannot borrow your way through retirement. Depleting your financial reserves could leave you financially dependent on your children. While putting away money for your children’s futures is important, you should get your financial future in place first.

-

Falling for Too Good to Be True Offers

Studies estimate that around 5 million Seniors each year fall for scams, losing an average of 36.5 billion dollars each year. Experts believe these numbers are grossly underreported, meaning the problem could be much worse than the numbers suggest.

Many seniors, struggling financially and with limited avenues to increase their income, are vulnerable to financial scams by strangers, friends, and even family members. Thirty-seven percent of complaints were filed by individuals 60 and older. Scam artists steal money in a way that you cannot recover from the losses. They might have you purchase gift cards, wire transfer money, or hand over cash. Their methods make the recovery of stolen funds unlikely.

When you receive a telephone call from a stranger offering a good deal, hang up. When someone presents a risky investment, pass on the once-in-a-lifetime opportunity unless you thoroughly understand and investigate the deal.

Guarantees and the promise of spectacular profits within a short period should raise red flags. Other red flags might include: The request to wire money, charging a fee to receive a prize, demanding personal information including bank account, credit card numbers, your social security number, or other sensitive information.

Be willing to walk away if you feel pressured to make an immediate decision or you are discouraged from investigating the offer.

If you suspect a scam, you can complete an internet search of the company name or product name to find reviews, complaints, or scam warnings. The consumer protection office, the FTC, or state attorney general are other places to find information on the legitimacy of offers and to file a complaint.