Legal Ways to Lower Your Tax Bill

During the 2016 tax season, Americans had an average gross income (AGI) of $67,564, with a federal tax hit of $9,665. Overall, this means the average family pays taxes at the federal rate of 14.3%. These figures include low-income workers with a negative federal tax bill due to the earned income tax credit. Removing those with a negative tax bill brings the average federal taxes owed to $14,654.

A few effective strategies to lower your tax bill legally can put more money in your pocket.

-

Fund A Traditional IRA

Contributing to an individual retirement account or IRA can lower your tax bill immediately because in most cases you can deduct the contributions made until the tax filing date. Tax-deductible contributions up to $5,500 before April 17, 2018, qualify. Anyone 50 and over can add another $1,000 to the maximum allowable deposit.

-

Choose Investments with Tax-Free Earnings

Earnings from Treasury securities are typically not taxed at the state level, reducing state income taxes due. Other investments, which avoid taxation include national, local, and state municipal bond funds. In some cases, you avoid both federal and state taxes on these investments.

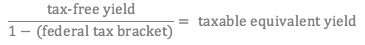

To determine whether a tax-free bond is better than a taxable bond, divide the tax-free yield by one minus your federal tax bracket.

For example, if your current income places you in the 33% tax bracket, your divisor is 0.67 (1 - 0.33). In this instance, a tax-free bond paying 5% would pay equivalent to a taxable bond paying 7.46%. (5 ÷ 0.67).

-

Use Treasury Bills to Defer Taxes

Treasury Bills or T-bills are short-term government securities, which receive the same tax treatment as other treasury investments. Due to the short-term nature of T-bills, they pay interest at maturity, rather than every six months, allowing you to defer taxation by investing in bills maturing the following tax year.

All investments in US Treasuries pay federal taxes, but not at the state or local level.

-

Eliminate the Capital Gains Tax

Workers earning income in the 10-15% bracket, include joint filers with income less than $75,900 and individuals earning under $37,950, pay no taxes on long-term capital gains. Investments held over 12 months qualify for long-term capital gain treatment. Selling profitable investments in a qualifying year can eliminate taxation on the profits.

One strategy is to sell a profitable investment, giving you tax-free gains, and then buying the investment back at the higher cost basis, lowering future taxation. The above strategy does not apply to investments held in a tax-preferred account such as an IRA or 401K.

-

Claim Overpayment to Social Security

Earning above $118,500 typically results in overpaying social security taxes. You can claim the overpayment on the 1040.

-

Take all Credits and Deductions Allowed

Fear of an audit can result in overpaying your taxes. For example, if you can legitimately claim the home office deduction, keep records to prove your claim and take the deduction.

Other commonly missed deductions include Job changes and moving costs, Lifetime Learning Credit, and the Earned Income Credit (EIC) (even if you were unemployed part of the year).

For the EIC a family with two parents and three children can earn up to $53,505 and still qualify. Job change deductions include expenses such as preparing your resume and the cost of traveling to an interview, provided you are searching for employment in the same field. You can also deduct moving costs if you meet the IRS criteria.

The Lifetime Learning Credit gives you a tax break on educational costs and can reduce your taxes by up to $2,000. Income cannot exceed $65,000 for a single filer or $131,000 a married couple filing a joint return.

-

Save Your Raise

An increase in income is the perfect time to raise 401k contributions, and lower your tax bill. You can contribute up to $18,000 annually, and those over 50 can contribute an additional $6,000.

-

Fund A Healthcare Savings Account (HSA)

A Healthcare Savings Account gives you an immediate tax deduction and grows tax-free, provided you use the money for qualified healthcare costs. Maximum contributions for 2017 are $3,400 for individuals and $6,750 for a family.

-

Keep Receipts

You must maintain records of anything you want to claim. Acceptable documentation can include a written record, receipts, and other proof you qualify for the deduction or credit.

-

Gain a Tax-Free Benefit by Selling Your Home

You do not pay taxes on up to $250,000 of profit from the sale of your home for singles and up to $500,000 for couples. The home must be a primary residence, and you must live in the home for two of the last five years. Moving can reset the clock for additional tax-free gains on the sale of your next home. The IRS does not restrict how often you can claim a tax-free profit on the sale of your primary home.

-

Don't Underestimate the Cost of Home-Equity Debt

The IRS allows for a deduction of Interest on balances up to $100,000 for home equity line debt secured by your home, regardless of how you used the funds. However, if you are subject to the alternative minimum tax (AMT), home-equity debt is only deductible if the loan was used to buy or improve your home.

-

Second Homes Can Offer a Vacation from Taxes.

Second homes can provide a tax break in the form of a mortgage deduction, provided the balance on the loans for both the primary and secondary home is under $1.1 million. Property taxes are also deductible provided you itemize.

Using the second home as a rental can provide additional tax benefits because all the expenses on the home become deductible as well as depreciation, which can often offset any income generated.

-

Check the Calendar Before Selling Investments

You pay either short-term or long-term capital gains on the sale of investments. Investments held under one year, 365 days, pays taxes as ordinary income. Hold an investment for over 12 months, and you pay taxes at the lower capital gains rate. The holding period starts on the day after you buy a stock, mutual fund, or other asset and ends the day you sell it.